Advantages and disadvantages of the best solutions available on the market to buy and sell bitcoin without undergoing KYC/AML procedures.

In this guide, we explore the most popular and reliable services on the market for buying and selling bitcoin without KYC/AML procedures, with the advantages and disadvantages of each. The order is completely random and does not constitute a difference in quality between the services.

Hodl Hodl

Hodl Hodl is a peer-to-peer (P2P) exchange platform that allows users to buy and sell bitcoin without the need to verify their identity. Launched in 2018, the company is based in Riga, Latvia, and is the organizer of the Baltic Honeybadger conference.

The information required for registration includes an email address and a password. Once registered, users can create customized offers specifying sale conditions such as exchange rate, payment method, and other preferences.

Hodl Hodl operates based on a system of 2-of-3 multisig escrow contracts. When a transaction is initiated, an escrow contract is created with three keys: one held by the seller, one by the buyer, and one by the platform itself. This system ensures that neither party can access the funds without the consent of the other party or without the intervention of the platform. If one of the two parties does not confirm the transaction, the platform intervenes to resolve the dispute using the third key.

To summarize:

Advantages

- Privacy: the absence of identity verification protects users’ privacy. Payment methods supported on Hodl Hodl include bank transfers, PayPal, Google Pay, N26, Stripe, Western Union, Transfer Wise, gift cards, and cash (physical meeting or envelope shipping).

- Security: the use of 2-of-3 multisig escrow contracts significantly reduces the risk of fraud. Funds are protected until both parties confirm that the transaction has been completed, and the platform can intervene in case of disputes.

- Reliability: the platform never holds users’ funds, reducing the risk of loss due to hacks or fraud.

- Usability: users can create customized offers with various payment options, making the platform accessible to a wide audience. However, the need to understand and manage 2-of-3 multisig escrow contracts can be complex for less experienced users.

- Costs: the platform charges a competitive fee for the P2P market: 0.6% per transaction, split equally between the buyer and seller.

Disadvantages

- Privacy: digital fiat payment methods such as bank transfers and PayPal “can leave traces”. Additionally, there is a risk of “Sybil attack”: when you don’t know the counterparty, it’s plausible that behind some users’ nicknames “government agencies interested in collecting data on P2P markets” may be hiding. In the past, there have been reported cases where federal agents infiltrated darknet markets to gather information and arrest participants. Similarly, government agencies could use platforms like Hodl Hodl to monitor transactions and identify involved users.

- Security: although the platform can intervene in disputes, the resolution process may take time.

- Reliability: the availability of offers can vary, making it difficult to find an immediate match for buying and selling. This can be a problem, especially for those who want to make quick transactions.

- Costs: while the 0.6% transaction fee is advantageous for the P2P market, it is undoubtedly expensive when compared to the world of centralized exchanges that require identity verification.

Bisq

Bisq is a decentralized exchange platform. Launched in 2014, the platform is managed by a Decentralized Autonomous Organization (DAO) and uses distributed nodes to ensure that there is no central point of control. Users can create or accept offers directly from the Bisq client which also manages the escrow service to protect transactions.

To use Bisq, users must download and install the client software, available for various operating systems. No identity verification is required to use the platform. Once installed, users can create a profile using a nickname and set up their account details, such as their preferred payment method.

Bisq’s operation is based on a decentralized escrow system. This system does not rely on 2-of-3 multisig contracts, but on security deposits and an arbitration mechanism involving mediators chosen by the Bisq DAO community. Specifically: when a buyer and seller agree on a transaction, both are required to deposit a certain amount of bitcoin as collateral in a 2-of-2 multisig address. After the buyer confirms payment to the seller, the escrow funds are automatically released.

If one of the parties does not confirm receipt of payment or if there are problems with the transaction, a dispute can be initiated which is handled by an arbitrator selected from the Bisq DAO community. The mediator examines the evidence provided by both parties and makes a decision on how to distribute the funds locked in escrow.

To summarize:

Advantages

- Privacy: no identity verification required. Supported payment methods include bank transfers, gift cards (such as Amazon), Revolut, Zelle, Western Union, MoneyGram, and much more.

- Security: the use of a decentralized escrow system reduces the risk of fraud. Funds are protected until both parties confirm that the transaction has been completed, and DAO mediators can intervene in case of disputes.

- Reliability: the platform never holds users’ funds.

- Usability: users can create customized offers with various payment options.

- Costs: fees are variable and depend on the transaction volume and payment method used.

Disadvantages

- Privacy: despite the absence of identity verification, payment methods like bank transfers can leave traces. Also in this case, users may be exposed to the risk of Sybil attack.

- Security: although the platform can intervene in disputes through DAO mediators, the resolution process might take time.

- Reliability: the availability of offers can vary, making it difficult to find an immediate match for buying and selling. This can be a problem, especially for those who want to make quick transactions.

- Usability: the need to download and install the client can represent a barrier to entry for less experienced users. Moreover, the interface might be less intuitive compared to centralized exchanges. Also, having to deposit bitcoin as collateral for trades means it’s necessary to already own a minimum amount of bitcoin.

- Costs: fees are variable and depend on the transaction volume and payment method used.

Robosats

Robosats is a peer-to-peer (P2P) exchange platform that exclusively uses the Lightning Network for fast and low-cost transactions. The platform is designed to be user-friendly and accessible even for beginners. No identity verification is required.

Users can access Robosats through a web interface or a mobile client. To get started, it’s sufficient to create an alias (nickname) and generate an API key. Once set up, users can create or accept offers specifying transaction conditions, such as exchange rate and payment method.

Robosats’ operation is based on an automated escrow system using Lightning Network hold invoices. A “hold invoice” is a type of invoice that locks funds in the sender’s wallet until the recipient decides to unlock them. When a seller creates an offer on Robosats, they must lock the funds in a hold invoice within a preset time: from 1 to 8 hours. If the seller doesn’t lock the funds in time, they lose their deposit. The buyer makes the fiat payment and, once confirmed by the seller, the bitcoin funds are released to the buyer. In case of a dispute, an arbitrator resolves the issue and the funds are released to the winning party.

To summarize:

Advantages

- Privacy: the buying and selling transaction on the Lightning Network generally ensures more privacy compared to an on-chain transaction. Supported payment methods include bank transfers, Revolut, Strike, Zelle, and CashApp.

- Security: the use of an escrow system integrated with the Lightning Network reduces the risk of fraud and speeds up transaction times.

- Reliability: the platform never holds users’ funds, reducing the risk of loss due to hacks or fraud.

- Usability: easy to use, even for the less experienced. Users can create and accept offers quickly, thanks to an intuitive interface and a simple setup process. It’s obvious, however, that knowing how to handle a Lightning wallet is necessary.

- Costs: fees are generally low due to the Lightning Network, which avoids paying on-chain mining fees. Moreover, the premium assigned compared to the market price of centralized exchanges is on average relatively low, with many offers even below 3%.

Disadvantages

- Privacy: as in the cases of Bisq and Hodl Hodl, digital fiat payments can leave traces and users can be exposed to the risk of Sybil attack.

- Reliability: the availability of offers can vary, making it difficult to find an immediate match for buying and selling. The average amount of offers is generally much lower than those found on Bisq or Hodl Hodl because Robosats does not operate on-chain but only with the Lightning Network and is therefore subject to the limits of its adoption.

Peach

Peach is a Swiss company that offers a peer-to-peer (P2P) exchange platform in the form of a smartphone app. The app is simple and intuitive, accessible even for beginners. Launched in 2022, it has established itself as a popular choice for those seeking privacy and ease of use.

To use Peach, users must register on the app by setting up an email address and password. As in the previous cases, once registered, users can create customized offers specifying sale conditions, such as exchange rate, payment method, and other preferences.

When a trade is initiated, the seller’s funds are locked until both parties confirm the completion of the transaction. If one of the two parties does not confirm the transaction, an arbitration procedure is started involving a third-party arbitrator designated by the platform to resolve the dispute.

To summarize:

Advantages

- Privacy: no identity verification. Supported payment methods include bank transfers, PayPal, N26, Satispay, PostePay, Revolut, Skrill, Wise, Amazon gift cards, and more.

- Security: the use of an escrow system significantly reduces the risk of fraud. Funds are protected until both parties confirm that the transaction has been completed, and a third-party arbitrator can intervene in case of disputes.

- Reliability: the platform never holds users’ funds, reducing the risk of loss due to hacks or fraud.

- Usability: Peach is perhaps the most intuitive and immediate service in the no-KYC market. It’s immediately usable by downloading a simple app.

Disadvantages

- Privacy: as in the previous cases, digital fiat payments can leave traces and users can be exposed to the risk of Sybil attack.

- Reliability: the availability of offers can vary, making it difficult to find an immediate match for buying and selling.

- Costs: the premium assigned to the market price of centralized exchanges is on average higher than what is found on services like Hodl Hodl, Bisq, or Robosats. Many sellers require a premium of even 10/15%. This is the cost of privacy combined with extreme ease of use.

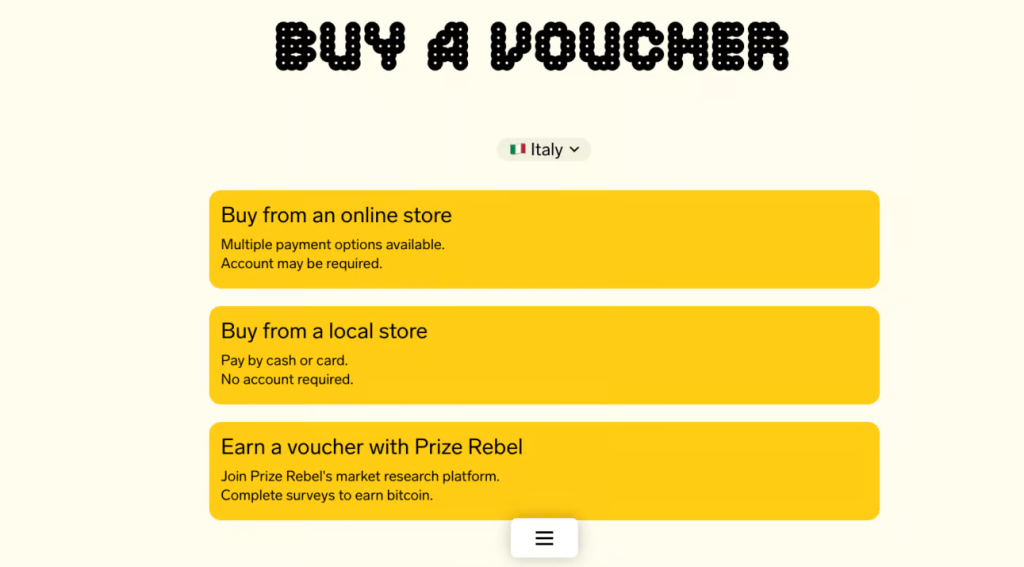

Azteco

Azteco is a service that allows users to purchase bitcoin through prepaid vouchers available at physical or online points of sale. In some countries, Azteco vouchers can also be purchased in cash, thus in an extremely private way, and redeemed online directly on Azteco’s official website. The vouchers are available in various denominations, for example 10, 50, or 100 euros.

To summarize:

Advantages

- Privacy: purchasing an Azteco voucher in cash at a physical location and subsequently redeeming it online is perhaps the bitcoin purchasing method that leaves the least possible traces, among those listed in this article.

- Security: Azteco does not require the creation of an account or the registration of personal data to redeem vouchers, eliminating the risk of identity theft and protecting users’ security.

- Reliability: since Azteco never holds users’ funds, there is minimal risk of loss due to hacks or fraud.

- Usability: extremely simple. All that’s needed to receive bitcoin is the voucher code and a bitcoin address to send the amount to. The process is quick and intuitive, truly accessible to everyone.

Disadvantages

- Privacy: purchasing vouchers online with traceable payment methods, such as credit or debit cards, can leave clues. Moreover, there’s a risk that online voucher resellers may collect data on buyers and their payment methods.

- Security: although Azteco doesn’t require personal data, purchasing vouchers online can expose users to fraud risks if reliable resellers are not used.

- Reliability: the availability of vouchers may vary depending on the region and authorized resellers. This can make it difficult to find available vouchers in certain areas.

- Usability: best preserving privacy is undoubtedly more inconvenient, as it involves physically going to a point of sale rather than doing everything online.

- Costs: fees are set by the business reselling the vouchers on behalf of Azteco. Generally, however, they can be very high, ranging around 10% of the purchase.

Bitcoin Voucher Bot

Bitcoin Voucher Bot is a Telegram bot managed by a Swiss entity that allows users to purchase bitcoin via vouchers. The bot is designed to facilitate bitcoin purchases in a simple and quick manner, without requiring identity verification for amounts under €900 per day.

To use Bitcoin Voucher Bot, users must start a conversation with the bot on Telegram. The bot will guide the user through the purchase process, which includes selecting the voucher denomination and payment method. Once the payment is completed, the user will receive a voucher code that can be redeemed for the corresponding bitcoin.

To summarize:

Advantages

- Privacy: no identity verification up to €900 per day. Users can purchase bitcoin without providing sensitive personal data, using only a voucher code.

- Security: by not requiring registration of personal information, the risk of data leaks is minimized.

- Reliability: the bot does not hold users’ funds, there is minimal risk of loss due to hacks or fraud. Funds are transferred directly to the bitcoin address provided by the user.

- Usability: extremely simple. Users can start a conversation with the bot on Telegram and follow step-by-step instructions to purchase and redeem vouchers.

- Costs: the fees for purchasing bitcoin through Bitcoin Voucher Bot are very competitive compared to other methods that don’t require identity verification: the cost of each purchase is equivalent to 2.5% of the total amount.

Disadvantages

- Privacy: above €900 per day, identity verification is required. The only available payment method is bank transfer. The user’s bank will know that the transfer is directed to a company that also offers bitcoin selling services.

- Usability: Bitcoin Voucher Bot is easy to use, but less experienced users might have difficulty understanding the use of Telegram for financial transactions.